A WHOPPING P65-billion fresh revenue is being eyed in taxes from Philippine Offshore Gaming Operators (POGOs).

Senate President Pro Tempore Ralph Recto raised this possibility upon President Duterte’s signing of an enabling legislation currently being crafted by Congress.

Once enacted as crafted by the Senate, a 5-percent franchise tax will be imposed on POGOs, apart from 2 percent in regulatory fee; while 25 percent income tax will be collected from POGO employees.

Recto, however, clarified that the revenue projection is possible only if the number of POGOs and POGO workers hit 2019 levels.

At a hearing held by the Senate Ways and Means Committee chaired by Sen. Pia Cayetano, Recto recalled that in pre-pandemic 2019, the Philippine Amusement and Gaming Corporation (Pagcor) issued licenses to at least 55 POGOs estimated to have employed 470,000 POGO workers, even as only 118,000 were listed in a Pagcor report.

The Senate President Pro Tempore made it clear it is not their intention to kill the POGO industry but the government is duty bound to impose “reasonable tax rates.”

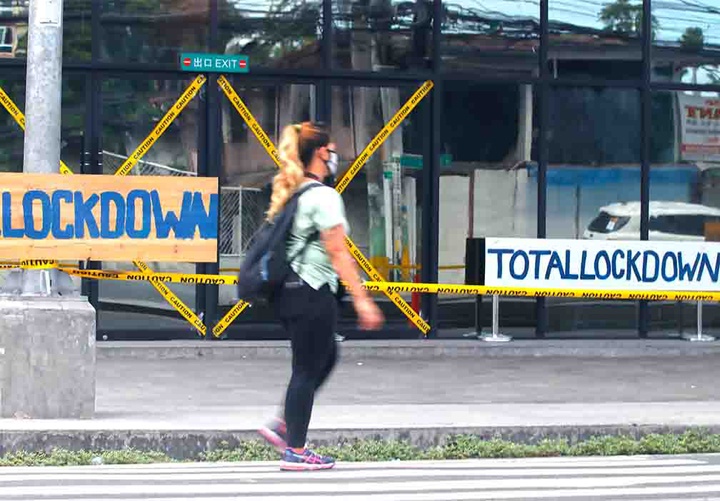

Recto said the Duterte administration needs to raise funding for urgent measures to effectively contain the pandemic, even as the country’s debt obligations continue to grow.

Statistics provided to the Senate showed that at present, the number of POGOs licensed by Pagcor in the wake of the pandemic was recently reduced to 38 with 42,417 workers.

Executives behind Pogos have insisted they are not liable to pay the 5 percent franchise tax since they are an offshore business. They gained a solid footing from a temporary restraining order (TRO) issued by the Supreme Court early this month.

The TRO effectively stopped the government from imposing the 5-percent franchise tax on the gross bets from gaming operations of POGOs as mandated under Republic Act 11494. The TRO was issued because the tax imposition was deemed as just a “rider” in the Bayanihan 2 law. Senators are backing the Bureau of Internal Revenue’s hope that, with a clearcut law amending the National Internal Revenue Code (NIRC), the government can finally collect the taxes it considers proper from the sector.

Image credits: Nonie Reyes

Read full article on BusinessMirror