A new generation of young professionals, defined by the realities of a global pandemic, are eschewing work at established corporations and jumping into start-ups. It’s a trend that’s lead to more tech activity in Southeast Asia (SEA), says a Thai venture capitalist running a $30 million fund hunting for investments.

When the venture-capital arm of Thai Oil Pcl began looking for tech start-ups to help its businesses become more efficient and diversified in 2020, it struggled to find companies with promising innovations rooted in hard sciences and applied engineering, Luck Saraya, Managing Director of TOP Ventures, said in an interview from Bangkok. Just 12 months on, there are many more offerings, with a new crop of entrepreneurs who’ve thrown conservative attitudes about working in start-ups out the window, he said.

“This younger generation are more willing to take the risk to work for a start-up—that’s a mindset that didn’t exist before,” Saraya said. “Just a few years ago, young people wanted to work in a big company with high job security. Now we’re seeing more lean toward tech.”

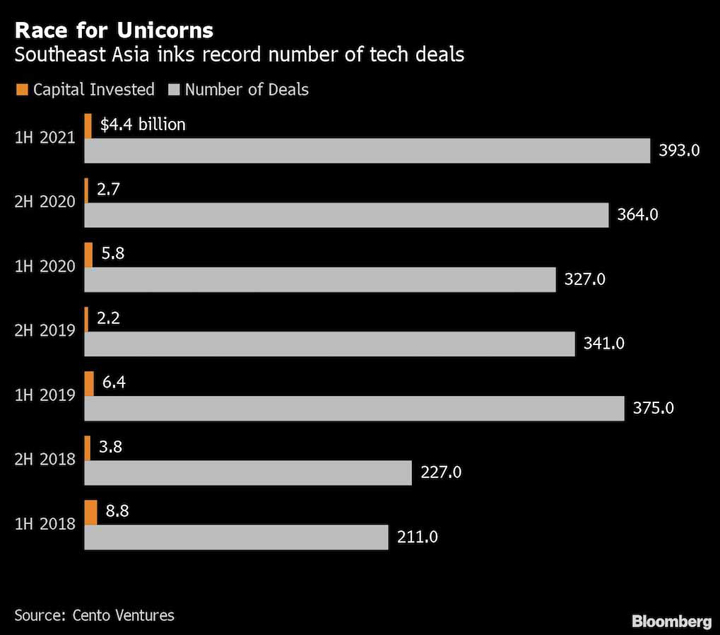

Although Covid-19 has decimated tourism and retail in SEA, the region is home to some of the fastest-growing Internet markets. Venture backers made a record 393 deals in the first half of 2021, raising $4.4 billion by investing in start-ups across SEA, according to Cento Ventures.

TOP Ventures has been in on the frenzy. Since 2020, the company has backed three venture capital funds and invested directly in four start-ups, deploying about $18 million. It plans to invest the rest of the fund’s money by next year and is looking for start-ups with innovations in manufacturing, food and biotech as well as electric vehicle and battery innovations.

It also invested $5 million last month in the AEF Greater Bay Area Fund, with Alibaba Hong Kong Entrepreneurs Fund as an anchor investor. The company aims to invest in promising Chinese start-ups working in the EV or autonomous driving space, said Saraya.

‘Old money’

ON the other hand, some of SEA’s old-money tycoons are boosting investment in technology start-ups, looking to ride a wave of surging valuations as they seek to counter the fallout of the pandemic on businesses ranging from retail to hospitality and manufacturing.

Holding companies, family investing arms and other vehicles of moguls from Thailand’s Dhanin Chearavanont to the Philippines’ Lance Gokongwei are either plowing millions of dollars directly into promising companies or setting up venture capital funds. Partnering with Silicon Valley venture capital firms is also gaining popularity.

With the flurry of investments, these traditional brick-and-mortar business empires are also transitioning to a new world of e-commerce and digitization, paving the way for fresh revenue streams after being crippled by months of lockdowns and travel restrictions. The pivot has gained even more urgency under a new crop of leaders—in some cases younger, third-generation heirs.

“The universe of family money in SEA has become very alive to what technology and tech investments are bringing because of recent start-up successes,” said Vishal Harnal, managing partner of 500 Startups Southeast Asia, which was an early investor in ride-hailing giant Grab and online marketplace Carousell. “There’s a lot more family money coming in to chase that, and the pandemic’s accelerated that race.”

The conglomerates, which have helped power SEA’s economies for decades, are now facing some tough challenges as governments still battle to contain Covid-19 infections. The Asian Development Bank last month slashed the 2021 growth outlook for the region to 3.1 percent, saying “developing Asia remains vulnerable” to the pandemic.

Although Covid-19 has decimated tourism and retail in SEA, the region is home to some of the fastest-growing Internet markets. Venture backers made a record 393 deals in the first half of 2021, raising $4.4 billion by investing in start-ups across SEA, according to a separate research by Cento Ventures.

Among the leaders in the race is Charoen Pokphand Group Co., a 100-year-old Thai conglomerate spanning agri-food to retail and telecommunications. The group’s senior chairman is Dhanin, the head of Thailand’s wealthiest business dynasty.

Bangkok-based CP Group led a series C investment round in start-up Ascend Money in September—backed by Jack Ma’s Ant Group Co.—that spawned Thailand’s first fintech unicorn with a valuation of $1.5 billion. CP Group also partnered with Siam Commercial Bank the same month to set up a $800 million emerging-technologies venture fund, seeding it with $100 million each.

“CP Group is actively embracing innovation and exploring advanced technologies such as robotics, logistics, cloud and other digital technologies,” said Yue Jun Jiang, CP Group’s chief technology officer. “Southeast Asia is going into a golden era of transformation where corporations are upgrading with advanced technologies and new business models, and the pandemic has further accelerated digitization.”

In Indonesia, Intudo Ventures raised $115 million to close its third fund in September to focus on the region’s biggest digital economy. Investors in the fund include more than 30 Indonesian families and their conglomerates, according to the company.

Plug and play

Plug and Play Tech Center, a Sunnyvale, California-based early-stage investor that’s backed more than 20 unicorns including PayPal Holdings Inc., has signed on more than a dozen partners in SEA, most of them family-controlled groups. They include Philippine construction-to-power conglomerate Aboitiz Power Corp. in the Philippines, Thailand’s CP Group and Indonesia’s Astra International.

While the surging valuations may be alluring, the groups face some risks as they embrace the tech strategy.

Early stage companies typically burn a lot of cash before showing any signs of gaining traction in their businesses. They also require a lot more support and guidance than established corporations may be willing to offer. Plus, the conglomerates also have to jostle with investors with deeper pockets and longer experience such as sovereign-wealth and venture capital funds.

But many family-owned businesses are undaunted by the challenges. Some have started pilot projects with tech start-ups with the aim of investing in those with promising technologies. They are seeking deals and partnerships that run the gamut from manufacturing automation to sustainable innovations, as well as fintech, health tech and electrical vehicles.

“They’re looking at what will impact their business, like the pandemic, and they need to develop new ideas,” said Shawn Dehpanah, Plug and Play’s executive vice president and Asia-Pacific head of corporate innovation and investment. “These big corporations are the pillar for speeding up innovation among start-ups now.” Bloomberg News