A STUDY commissioned by the government has advised against pursuing a full-blown sugar trade liberalization at this time given severe distortions in the world sugar market.

The study titled, “An Assessment of Reform Directions for the Philippine Sugar Industry,” conducted by Brain Trust Inc. and commissioned by the National Economic and Development Authority (Neda), found that sugar liberalization will favor the rich more than the poor.

Based on the findings, the full liberalization of the trade in sugar would lead to a 57-percent decline in the profits of planters and millers while consumers will see a gain in welfare of 65 percent. The net gain, the study found, is only 1.8 percent which is equivalent to P2 billion.

“The case for sugar trade liberalization appears weak at this time. Should it be pursued nonetheless, it would best be done gradually and only partially, especially in the face of severe distortions in the world sugar market,” the report stated.

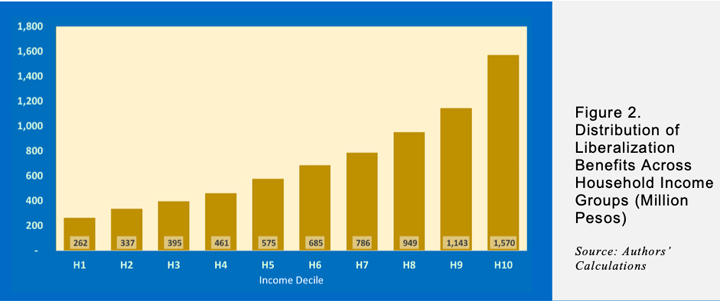

Data showed that the impact of sugar trade liberalization on the welfare of households who are consumers of the product would be uneven across income classes.

The lowest income decile would gain P262 million while the richest decile stands to gain as much as P1.6 billion. The study noted that this reflected higher consumption levels of the affected products by richer households.

“All told, liberalization would benefit consumers but would favor the rich more than the poor. All this would be at a clear cost to the sugar industry stakeholders,” the study noted.

Inter-industry effects

Meanwhile, the study found that if inter-industry effects are accounted for, Philippine society will gain P7 billion to as much as P9 billion annually if sugar trade is fully liberalized.

The increase in welfare is mainly due to lower prices of sugar and sugar-using products. This is, however, accompanied by as much as an 11-percent decline in prices and 6.8-percent contraction in domestic sugar industry production.

The data also showed there will be a 7-percent decline in employment in sugar manufacturing while employment in sugarcane production will be cut by 16 percent.

Meanwhile, the study said the benefit of sugar trade liberalization on the industry sector was small at only 0.08 percent by 2030.

Food manufacturing industries including those using sugar could see output increase by 1 percent and employment 1.1 percent.

They will also experience reduced prices of 0.24 percent to 0.41 percent and imports for these commodities will decline over time by just under 1 percent.

“While industrial users of sugar would benefit, the impact on them appears relatively modest. It may be noted that the case for reducing prices for consumers at the expense of industry stakeholders is not as compelling as it has been for rice,” the study noted.

“Thus, even as liberalization would lead to a net overall welfare gain for society, the net gains to be achieved may not be substantial enough to offset the downsides in terms of adverse distributional impacts and non-economic costs in the social and political realms,” it added.

The research said that if the government chooses to pursue sugar trade liberalization at this time, this is best done by gradually easing control over the sugar trade.

In order to do this, the Sugar Regulatory Administration (SRA), Department of Agriculture (DA), and Neda could determine the pace of decreasing the quantitative restrictions within a defined period of three, five, or more years.

The three institutions can also set parameters for annual sugar import volumes that take into account global and local market conditions. This is with the aim of easing restrictions in order to lower local prices.

They, the study noted, should also establish a monitoring and evaluation mechanism to allow the proper calibration of the phased liberalization process.

Full liberalization, the study noted, can only be done when “long-standing distortions in the world sugar market” are removed.

This means the government should join the call for reforms in the global sugar industry at the World Trade Organization (WTO), G-77, Unctad and the UN Food and Agriculture Organization (FAO).

This call supports the elimination of “distortive” state subsidies to domestic sugar industries in major exporting countries.

“The Philippine government needs to make a forceful plea for international economic justice that is compromised by these persistent distortions in the world sugar market,” the study noted.

Neda’s pitch

In 2019, Neda said the liberalization of the sugar industry will help bring down the cost of sugar in the country. Liberalizing the sector may involve the removal of the licensing powers of the SRA and the cost involved in sugar importation.

The SRA was created through Executive Order 18 of former President Corazon Aquino. It is tasked to issue permits and licenses, as well as collect fees and levies on the processing and manufacture of sugar and its by-products.

EO 18 was strengthened by Republic Act 10659 or the Sugarcane Industry Development Act (Sida) of 2015. Under Section 9, the SRA is tasked to classify imported sugar to meet domestic sugar requirements.

Under the Sida, the Bureau of Customs (BOC) will also require importers or consignees to secure from the SRA the classification of the imported sugar prior to its release.

Neda Undersecretary for Planning and Policy Rosemarie G. Edillon explained that these processes make sugar more expensive. She added that importers are charged around P200 per 50-kilogram bag of sugar that they need to import to meet their requirements.

This cost is termed as the certificate of reclassification rights which importers purchase to obtain an import volume allocation. This will allow them to obtain their shipments from the BOC.

Edillon said that even if there were already adjustments made by the SRA to cut red tape and release documents needed after one day, the certificate of reclassification rights remains expensive.