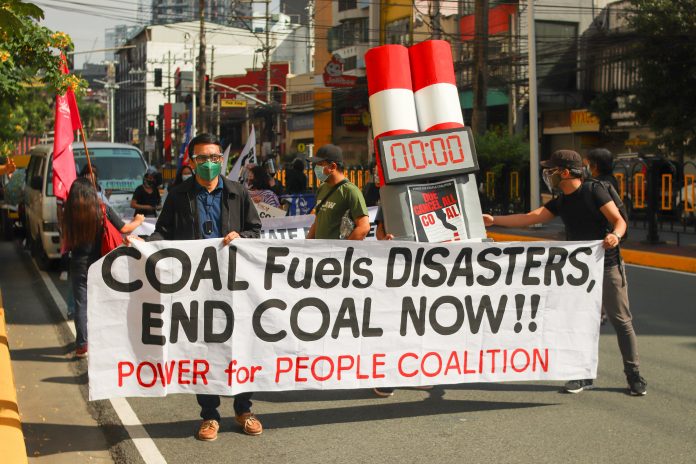

Philippine banks are still bankrolling coal projects despite the country’s climate change problems and a pandemic that has cut energy use.

According to the Coal Divestment Scorecard of the civil society and church-led campaign Withdraw from Coal (WFC), overall funding by local banks for coal projects in the country remains on an upward trend.

“Philippine banks would do well to use the rest of 2021 to enforce tipping points that will shift the landscape out of coal’s favor completely,” said the WFC.

“Policy pronouncements and disclosures from the banks on withdrawing support to coal developers and projects, if made immediately within this period, will create ripples and potentially influence the Philippines’ energy direction in strengthening its Nationally Determined Contribution [to the Paris Agreement], engaging in international climate arenas, as well as shaping the conversation on coal in the upcoming national elections,” it said.

The scorecard is a tool developed by WFC to help Philippine banks and their stakeholders assess their exposure to coal and the accompanying risks and impacts of financing it.

The WFC said their April 2021 scorecard is an invitation to Philippine banks for continued engagement with their stakeholders to advance sustainability and climate ambitions and an encouragement to seize opportunities to “fast-track the country’s energy transition.”

The scorecard says the Bank of the Philippine Islands (BPI) retained its position from the December 2020 with the highest exposure to coal, occupying the biggest share from the total loans and underwriting among 15 banks at 27% and 17%, respectively. Overall, BPI has funded at least 15 coal plant projects and six coal developer companies, according to the WFC.

BPI is closely followed by the Philippine National Bank (PNB) and BDO Unibank, which retain their ranks as the second and third top coal financiers in the country. PNB financed nine coal plants, while BDO, the largest bank in the country, financed at least 14 coal plants.

The WFC said they hope the scorecard would help the banks and their shareholders strongly consider “adopting more urgent coal divestment policies and taking climate action efforts aligned with the Paris Agreement’s 1.5°C temperature goal.”

The scorecard (released Tuesday, 21 April) was accompanied by a statement addressed to Philippine banks still funding the coal industry, which was signed by over a hundred representatives from civil society, Churches, local governments and coal-affected communities.

“We urge you to stop financing destructive energy from coal. The Philippines is teeming with clean and affordable sources of renewable power that are just waiting to be tapped. By closing coal’s money pipeline and moving over to investing fully in clean power, we believe you can open the door to a sustainable future for all Filipinos, and influence all other banks to follow suit,” the statement read.

Read full article on BusinessMirror