TIMING is right for the Philippines to set up its Maharlika Investment Fund (MIF) amid fears that headwinds could thrust much of the world into near-recession levels, a senior lawmaker insisted on Monday, the eve of the expected signing of the controversial MIF into law.

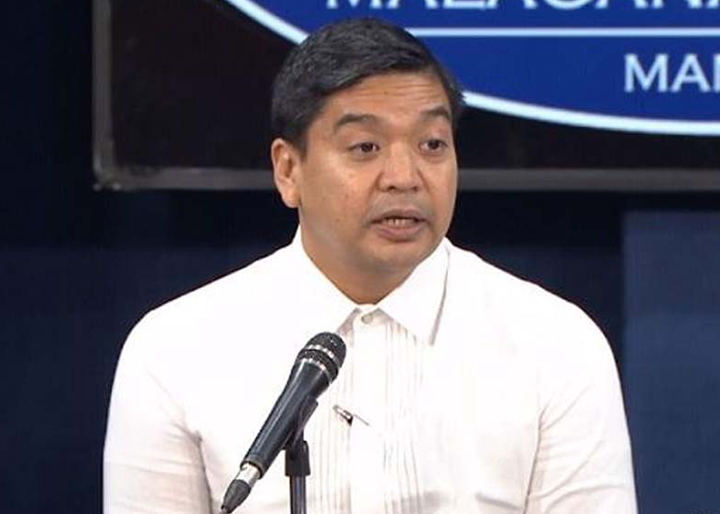

At a time when the Philippines has received an investment or credit rating upgrade, President Ferdinand Marcos Jr.’s expected signing Tuesday of the MIF law will undoubtedly provide the country with a new growth stimulant, according to Camarines Sur Rep. and National Unity Party (NUP) president LRay Villafuerte.

Despite warnings by some economists that this is the worst time to be courting investments as problems slash outputs in much of the developed world, Villafuerte said the MIF will clear the way to an alternative, potentially huge source of investment funds that would enable the national government to spend much bigger on public infrastructure and its other big-ticket programs to shore up the President’s “Agenda for Peace and Prosperity.”

A principal author of the MIF law, Villafuerte explained that, “The 19th Congress, in writing this MIF measure, sought to fit up government with a new funding stream for investments other than the traditional sources of funds, namely, the General Appropriations Act (GAA) or national budget, official development assistance (ODA) from our overseas partners and the business sector via the public-private partnership (PPP) mode.”

He added: “The establishment of the MIF, which our economic managers expect to be up and running before 2023 is over, is timely at this time when the Philippines has secured a higher investment-grade status even as the world economy is going through a rough patch that experts fear could slash global output to near recessionary levels.”

He was referring to the recent warning by the International Monetary Fund (IMF) that the global economy could suffer a pronounced growth downturn this year to 2.5 percent to 2.8 percent from 2022’s 3.4 percent, because of the precarious phase of stubborn inflation, slow recovery from the pandemic, prolonged Russia-Ukraine war, increasing trade tensions, and interest rate hikes by central banks, among others.

For Villafuerte, one bright spot for the Philippines amid the downtrend in the global economy is Fitch Ratings’ revision or upgrade last May of its Philippines’ Long-Term Foreign-Currency Issuer Default Rating (IDR) to “Stable” from “Negative” and affirmation of its “BBB” rating. This, he said, “reflected the credit watcher’s confidence that our country is heading for strong medium-term growth after the pandemic, on the back of its sound economic policy framework.”

Villafuerte said the MIF will serve as a growth driver for the domestic economy by attracting private investments despite external headwinds that heighten global economic and financial uncertainties and threaten the Marcos administration’s near- and medium-term agenda for inclusive and sustainable development.

Moreover, with the MIF as a new source for investment funds, the government can spend much more on its priority projects without resorting to additional foreign borrowings, he pointed out.

In becoming a new investment fund source for high-impact, economically viable programs and projects, he said “the MIF would help the NG prevail over two drawbacks that threaten to handicap the Marcos administration’s agenda to sustain the robust economic growth path post-pandemic, create jobs and attack poverty, and keep the Philippines on its AmBisyon Natin 2040 path of becoming a prosperous middle-class society in less than two decades.”

And these two main challenges to high and inclusive growth, he said, are, “One, the government’s presently limited fiscal space as a consequence of the immense public spending on Covid-19 response that the preceding Administration have had to resort to; and second, the economic slowdown across the world.”

Villafuerte allayed fears that the MIF could deplete the resources of its two main fund sources—the Land Bank of the Philippines (LandBank) and Development Bank of the Philippines (DBP)—and trim the outlays of these two government financial institutions (GFIs) that would otherwise go to sectors such as agriculture and industry.

The Maharlika Investment Corp. (MIC), which will handle the MIF, has an authorized capital stock of P500 billion; and its initial paid-up capital will be P125 billion—P50 billion from the LandBank, P25 billion from the DBP, and P50 billion from the NG.

The NG will source its MIF funds from the dividend contributions of the Bangko Sentral ng Pilipinas (BSP), the NG share of Philippine Amusement and Gaming Corp. (Pagcor) earnings, and proceeds from the privatization or sale of government assets.

As pointed out by economic managers, Villafuerte said the P50-billion and P25-billion contributions of the LandBank and DBP, respectively, to the MIF are relatively small, considering that LandBank has P1.3 trillion in investible funds while DBP has P850 billion.

These GFIs’ contributions make up just 3 percent of the LandBank’s P1.3-trillion investible funds and 2.7 percent of the DBP’s investible funds, he said. The final congressional version of the enrolled MIF bill submitted to Malacañan Palace for the President’s approval and signature actually resulted from the agreement by members of the bicameral conference committee last May 31 for the House to adopt Senate Bill (SB) 2020, in lieu of reconciling it with HB 6608.