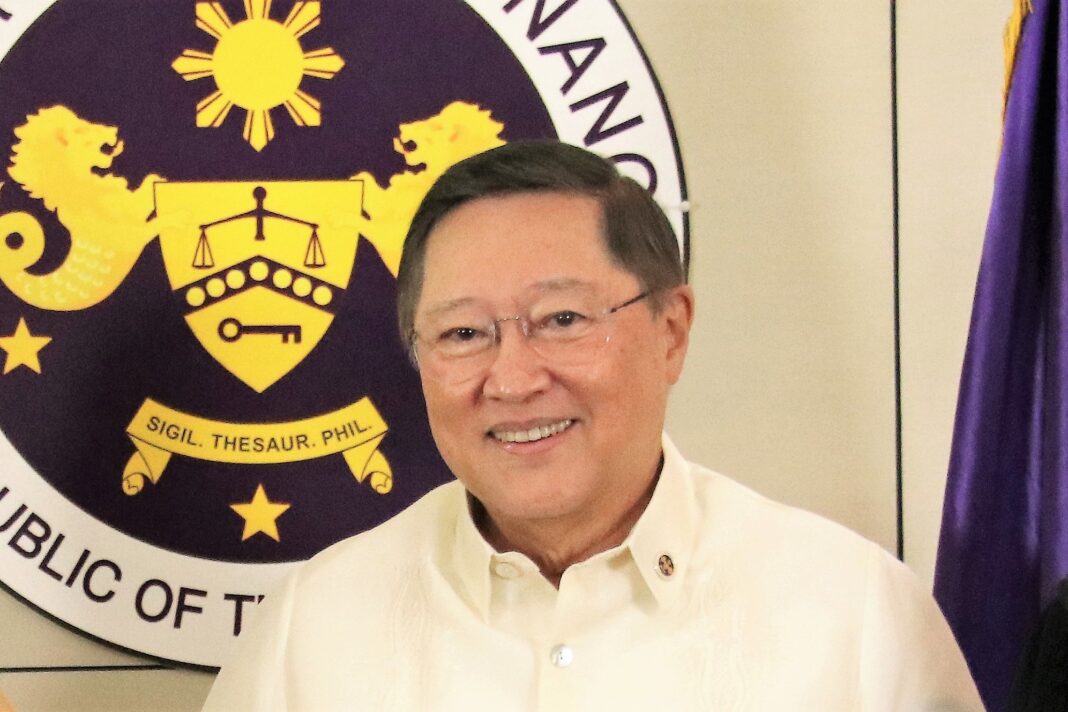

THE chief of the Department of Finance (DOF) said officials need first to see the final outcome of the Chapter 11 bankruptcy proceedings for the Philippine Airlines Inc. (PAL) before they decide whether government banks help bail out the flag carrier.

Finance Secretary and ex-PAL CEO Carlos G. Dominguez III explained on Thursday the wait-and-see stance by noting that “bankruptcy courts do not necessarily always follow what we want.”

“We will have to wait for the result of the bankruptcy proceedings because I do not want Land Bank [of the Philippines] and [the] DBP [Development Bank of the Philippines] to go in and finance a company that is filing for bankruptcy and we don’t know how will it turn out,” Dominguez told senators during the Cabinet-level Development Budget Coordination Committee briefing on the proposed 2022 national budget.

In the meantime, Dominguez said they are already reviewing the bankruptcy filing, which a government financial institution was able to get hold.

“We are following this very carefully and, if at the end, it looks like it will be a prudent investment for the taxpayers’ money, yes, we will participate,” Dominguez added. “But the conditions are there plus the additional conditions that we have to see the final outcome of the bankruptcy proceedings in New York.”

Apart from the condition that the government needs to wait for the outcome of the bankruptcy proceedings, Dominguez said other conditions must be met before government participates in financing the airline company.

According to Dominguez, these other conditions were also met in the case of budget carrier Cebu Pacific, wherein state-run lenders provided 18 percent of the total financing package.

The Finance chief added they are not keen on ending up owning the companies.

“So I said, what we will require in any restructuring is that, number one, major shareholders put up additional adequate capital. Number two, all the current creditors participate in relieving the financial problem of the airlines. Number three, that local banks participate in the financing,” he said.

“If all those conditions [are met], and that we are satisfied with the management of the company and only then will the government financial institutions participate, and frankly we did in the case of Cebu Pacific,” he added.

While government banks were not the biggest financiers in case of Cebu Pacific, Dominguez said they are the ones who provided “keystone finance.”

“You know the keystone in an arch is the stone without which nothing happens; the arch is not built,” he explained.

Last week, PAL announced it had filed for Chapter 11 bankruptcy protection in New York as it works out a “consensual” restructuring plan with creditors, suppliers and shareholders.

PAL said it has entered into “a series of agreements with substantially all of the Company’s lenders, lessors, and aircraft and engine suppliers, as well as its majority shareholder, to allow the Company to successfully restructure and reorganize its finances to navigate the Covid-19 crisis and emerge as a leaner and better-capitalized airline.”

The restructuring plan, which is subject to court approval, provides over $2.0 billion in permanent balance sheet reductions from existing creditors and allows the airline to consensually contract fleet capacity by 25 percent and includes $505 million in long-term equity and debt financing from PAL’s majority shareholder and $150 million of additional debt financing from new investors.

The company said it “voluntarily filed for a pre-arranged restructuring under the US Chapter 11 process in the Southern District of New York to implement the consensual restructuring plan” with creditors. PAL “will also complete a parallel filing for recognition in the Philippines under the Financial Insolvency and Rehabilitation Act of 2010.”

PAL said it will continue to operate flights in the normal course of business in accordance with safety regulations, “and the company expects to continue to meet its current financial obligations throughout this process to employees, customers, the government, and its lessors, lenders, suppliers and other creditors.”