European stocks and US equity futures fluctuated as investors assessed prospects for less-aggressive central bank tightening and weighed China’s latest move to stimulate its economy.

The Stoxx Europe 600 Index erased a decline, with energy stocks outperforming as oil pared its weekly drop. The regional benchmark is on course for a sixth week of gains, the longest winning streak in a year.

Contracts for the S&P 500 and Nasdaq 100 inched higher, with energy companies echoing gains in their European peers in premarket trading. Apple Inc. slipped after a report that production of iPhones in November could fall by at least 30% at a Chinese plant where worker protests have disrupted operations.

Wall Street shares are poised to end the Thanksgiving week higher, rising after recent commentary from Federal Reserve officials that supported the case for a slower pace of interest-rate increases.

The dollar fluctuated after three straight days of losses. Treasuries steadied after rising during Asian trading. US markets will have a shortened session on Friday.

China’s central bank on Friday cut the amount of cash lenders must hold in reserve for the second time this year, an escalation of support for an economy racked by surging Covid cases and a continued property downturn. The offshore yuan edged lower.

The outlook for Chinese markets is improving, despite the current flareup in virus cases, according to Jun Bei Liu, a portfolio manager at Tribeca Investment Partners.

“In the next 12 months things will get better. We have seen this playbook before across other economies,” she said on Bloomberg Television. “We’ll begin to see outperformance very soon in the next few quarters.”

Meanwhile, JPMorgan Chase & Co. quantitative strategist Khuram Chaudhry said the rebound in European equities driven by expectations of peaking inflation and bond yields is nothing but a bear market rally and that investors are “jumping the gun.” He forecasts euro-area equities will eventually recover “later in 2023.”

Oil recouped some of its third weekly loss as the European Union weighed a higher-than-expected price cap on flows of Russian crude and slowdown concerns threaten the outlook for energy demand. Gold was poised for a modest weekly gain.

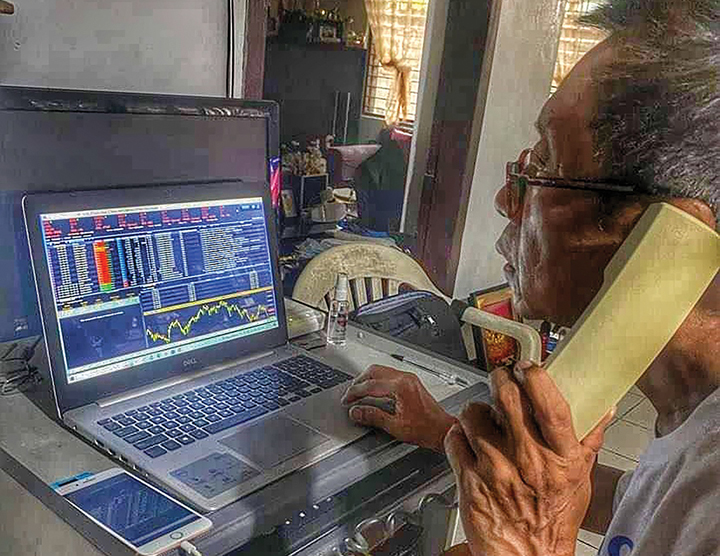

Image credits: Nonie Reyes